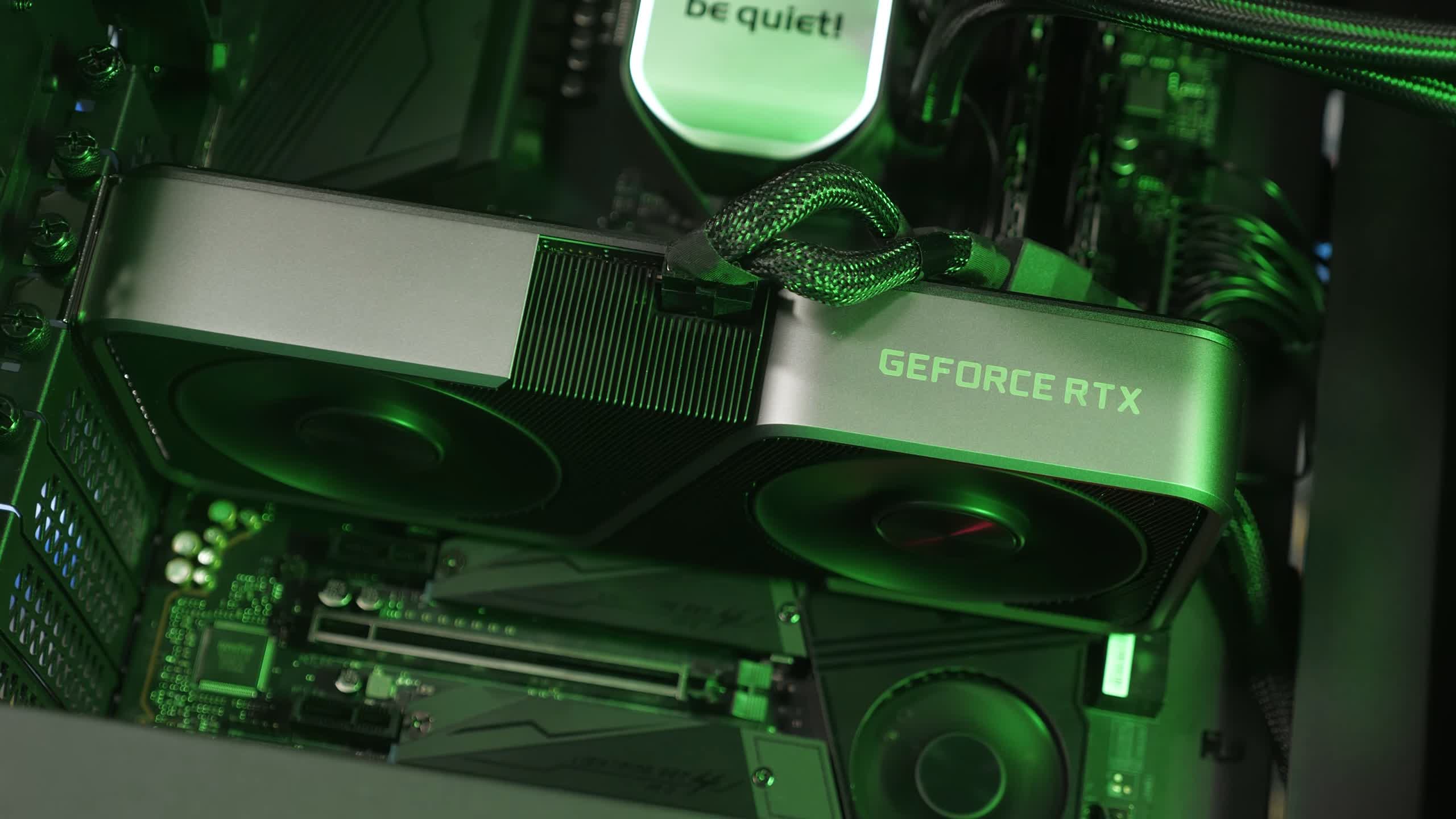

It's that time of the month when we provide you with an update on the current state of the GPU market. The good news is that in the past few weeks graphics card availability has started to improve, with a notable drop in GPU prices across the board, both for Nvidia and AMD's current generation offerings, as well as for the majority of used GPUs from prior generations.

As a side note, last month we decided to stop tracking the CPU market as we observed that segment is basically back to normal and that continues to be true in July which is great news indeed. In fact, in our regular coverage we've mentioned how popular chips like the Ryzen 5600X is now selling at or below its $300 MSRP.

Updated: See our latest GPU Pricing Update here.

Driving Factors

The GPU price drop has been triggered due to a significant downward shift in the price of cryptocurrencies and a huge drop in GPU mining profitability. It's been over two months since coins like Ethereum broke their highest value record, with prices less than half of what they were during that peak. This positively affected GPU pricing in late May and throughout June, and continues to have an effect today.

But progress remains slow. Even though mining and cryptocurrencies are on a downward trend now, GPU pricing is not suddenly back to normal through regular retail channels. Like last month, availability is reasonably good for many cards in different regions around the world, but pricing remains highly inflated over the MSRP.

In Australia, a market which tends to be a good indicator for the PC hardware channel in general, last month we were looking at about half of the RTX 3070 GPUs listed at PC Case Gear being in stock and available, with prices starting around the $1800 AUD mark, that's more than double the MSRP. Today, more cards are in stock, and pricing has declined by $100 to $150 for this GPU, but clearly nowhere near the local $810 MSRP. There is some progress nonetheless, and it's a positive sign that restocks are coming with lower prices than previous shipments, likely due to distributors and AIBs seeing weaker demand at current prices.

AMD GPUs like the RX 6700 XT have also seen a small decrease in pricing and somewhat better availability, but to a lesser degree than the RTX 3070. Speaking to retailers, it sounds like GeForce availability has been a better relative to Radeon lately, especially at the higher end.

We are still hearing of several supply chain issues that are slowing any rush of new GPUs from hitting the market. Things like memory modules and other ICs that are critical for building a graphics card continue to face supply constraints, and prices to ship graphics cards from factories to stores also remains higher than in previous years. Demand is still high for GPUs which sees prices inflated due to natural market forces, but even if demand was low, it sounds like these factors would be preventing cards from hitting the optimistic MSRPs set before the supply problems started to heat up.

Ethereum Trending Down

The other key contributing factor are of course cryptocurrencies, so let's check what's happening there.

As of writing, Ethereum prices have fallen compared to a month ago. In our last GPU pricing check, Ethereum was sitting at ~$2300. Right now it's around $1800, a drop of 22%. Not as amazing as the 34% drop from month prior, but a marked decrease in crypto prices is what prospective GPU buyers want to see.

Also read: What is Cryptomining?

As you may be aware, it's not just the price of the coin that affects the profitability of mining. Overall difficulty as well as gas prices are important, too. Ethereum mining difficulty has been fluctuating over the last month, but month on month difficulty is down 8 percent. This means that fewer GPUs are currently mining on the Ethereum network - which is good as it indicates lower demand or interest in mining - however it also increases the reward to those who remain mining this coin.

Ethereum pricing chart

Meanwhile, gas prices have been flat throughout this month, not a bad thing for those wanting GPU prices to return to normal, but not as good as the huge decrease in gas prices we saw last month. When you combine this with the difficulty decrease and the decrease in Ethereum price, mining profitability continues to decrease slightly, but not to the same extent as it did the month before. A drop is a drop though, and that will have an effect on the GPU market.

Current Retail GPU Market

Tracking current generation GPU prices on eBay in the third week of each month for new products and completed sales shows good news across the board. GPU prices have fallen steadily month on month, with scalpers unable to sell their cards for as much as they did any other month stretching back to January approximately. These eBay prices effectively show us what people are willing to pay for GPUs right now, and there's a downward trend going, which should hopefully continue to pull the rest of the market with it.

| MSRP | eBay Average Price May | eBay Average Price June | eBay Average Price July | Current Price Inflation | Price Increase May to June | |

|---|---|---|---|---|---|---|

| GeForce RTX 3090 | $1,500 | $3,628 | $2,962 | $2,599 | 73% | -12% |

| GeForce RTX 3080 Ti | $1,200 | $2,187 | $1,905 | 59% | -13% | |

| GeForce RTX 3080 | $700 | $2,601 | $1,948 | $1,623 | 132% | -17% |

| GeForce RTX 3070 Ti | $600 | $1,323 | $1,085 | 81% | -18% | |

| GeForce RTX 3070 | $500 | $1,660 | $1,261 | $1,075 | 115% | -15% |

| GeForce RTX 3060 Ti | $400 | $1,617 | $1,255 | $1,012 | 153% | -19% |

| GeForce RTX 3060 | $330 | $977 | $830 | $723 | 119% | -13% |

| Radeon 6900 XT | $1,000 | $1,972 | $1,932 | $1,460 | 46% | -24% |

| Radeon 6800 XT | $650 | $1,690 | $1,450 | $1,282 | 97% | -12% |

| Radeon 6800 | $580 | $1,518 | $1,210 | $1,087 | 87% | -10% |

| Radeon 6700 XT | $480 | $1,088 | $907 | $733 | 53% | -19% |

| Average | 92% | -16% |

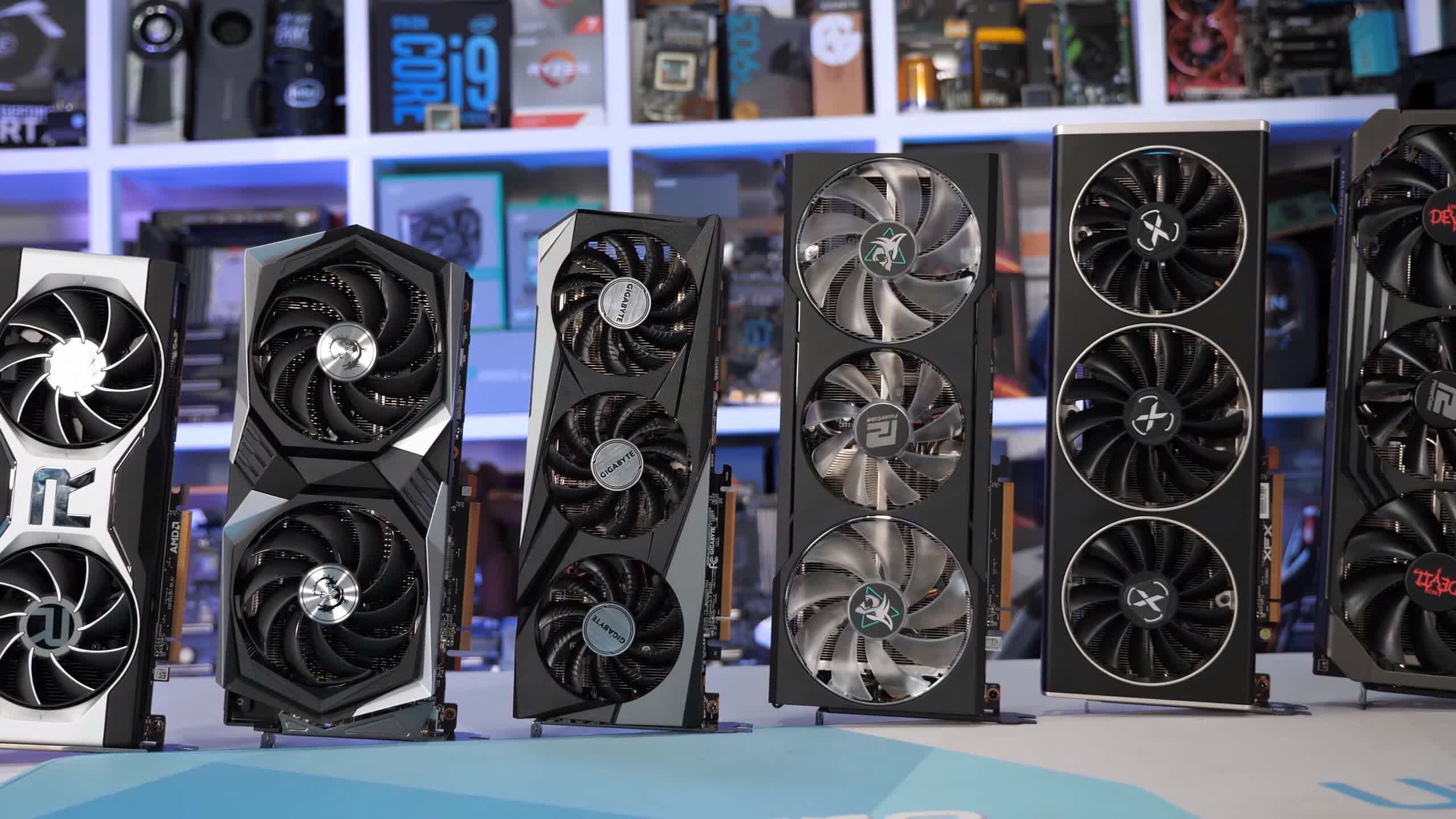

Nvidia GPUs continue to be inflated more than their AMD counterparts on the scalper market, though several GPUs - including the LHR enabled RTX 3080 Ti and RTX 3070 Ti - are now selling for less than double their MSRP. These cards have fallen in price by 12 to 19 percent, and due to pricing being linked to mining profitability to some degree, the RTX 3070 Ti through RTX 3060 Ti are all available for roughly the same price, which of course wouldn't be the case in a normal market.

On average, GPUs still cost roughly double their MSRP...

Meanwhile, on the AMD side, the price of the RX 6900 XT has tanked significantly, falling 24% in the past month, the highest of any current generation GPU. This puts this GPU much more in line with its performance and mining profitability relative to other GPUs, whereas before it was overly inflated. While on average, GPUs still cost roughly double their MSRP, these AMD cards are only inflated by 70%.

Like in prior months, the RX 6700 XT continues to be the best value current-gen card for gamers wanting to purchase a GPU right now. Its value is notably better than others in cost per frame using our latest 1440p benchmarks, helped by its poor mining performance and consumer preference for RTX GPUs - a nice bonus for people that research value like this.

We're actually in an odd situation where the GPUs we thought were not amazing value at their launch MSRP (the 6700 XT and RTX 3070 Ti) are actually among the best value GPUs on the scalper market right now.

On the other hand, it's arguably not worth buying a GeForce GPU at current prices that remain inflated above double the MSRP, and deliver worse cost per frame value than AMD GPUs. As prices continue to stabilize and if mining continues to drop in popularity, I'd expect these value equations to stabilize more around gaming performance, not mining performance where Nvidia has an advantage when comparing non-LHR-limited Ampere to RDNA2.

Using data from Whattomine, on average GPU profitability per day is down 13 percent compared to the same time last month, while GPU prices have dropped 16 percent. This has kept the time to profitability consistent at approximately 1 year if you bought a GPU right now and if there are no further reductions to profitability.

What's kind of interesting is that miners aren't the most forward-looking with their purchasing habits, or are optimistic that mining will either stabilize in profitability or return to a state of increasing profits. While people buying a card today are faced with 355 days on average until profitability, those that bought GPUs at prices from last month have seen their time to profitability increase by around 50 days due to a gradual reduction in profitability, in addition to a decrease in the resale value of their cards.

If these stats are a bit confusing, the basic summary is that buying a GPU for mining right now is looking like a bad investment. But hey, that's good for those that would rather see cheap GPUs from miners selling their cards on the used market. And of course, the crypto market is volatile, so we could be back again in August with a totally different story in this area.

How About Used GPUs?

Used GPU prices have also fallen in the past month, at a similar rate to current generation cards. Nvidia's GeForce RTX 20 series for example has fallen in price by 15% on average, with notably high declines for cards like the RTX 2080 Ti, which now sits below its $1,000 MSRP.

| MSRP | eBay Average Price May | eBay Average Price June | eBay Average Price July | Current Price Inflation | Price Increase May to July | |

|---|---|---|---|---|---|---|

| GeForce RTX 2080 Ti | $1,000 | $1,458 | $1,219 | $952 | -5% | -22% |

| GeForce RTX 2080 Super | $700 | $1,047 | $887 | $788 | 13% | -11% |

| GeForce RTX 2080 | $700 | $953 | $834 | $686 | -2% | -18% |

| GeForce RTX 2070 Super | $500 | $881 | $784 | $638 | 28% | -19% |

| GeForce RTX 2070 | $500 | $838 | $678 | $603 | 21% | -11% |

| GeForce RTX 2060 Super | $400 | $800 | $707 | $613 | 53% | -13% |

| GeForce RTX 2060 | $350 | $641 | $549 | $476 | 36% | -13% |

| Average | 20% | -15% |

However, people interested in prior generation GPUs at the lower end aren't so lucky, with the RTX 2060 still inflated with an average sale price of $476 compared to its $350 MSRP when it launched two and a half years ago.

The market is looking much better for GTX 16 series cards this month. When we checked in June, reductions in current generation high-end GPU prices due to the drop in cryptocurrency value hadn't yet caused much movement in pricing in the mainstream market segment. But this month, we're starting to see price drops trickle as far down as the GTX 1650, which has now fallen in line with drops in other GPUs. None of these cards are particularly amazing value right now with all priced well above their launch MSRPs, but lower prices are what we like to see.

| MSRP | eBay Average Price May | eBay Average Price June | eBay Average Price July | Current Price Inflation | Price Increase May to July | |

|---|---|---|---|---|---|---|

| GeForce GTX 1660 Ti | $280 | $585 | $481 | $428 | 53% | -11% |

| GeForce GTX 1660 Super | $230 | $582 | $495 | $425 | 85% | -14% |

| GeForce GTX 1660 | $220 | $497 | $430 | $359 | 63% | -17% |

| GeForce GTX 1650 Super | $160 | $346 | $326 | $291 | 82% | -11% |

| GeForce GTX 1650 | $150 | $299 | $295 | $248 | 65% | -16% |

| Average | 70% | -14% |

Then we get to the GeForce 10 series, which has a seen a larger than average price drop on the used market. At this point, every card with the exception of the GTX 1060 6GB now sits below its launch MSRP, a milestone for these old Pascal cards. It should be noted, this is not a great situation either, as most of these GPUs came out in 2016, but lower prices are welcome.

| MSRP | eBay Average Price May | eBay Average Price June | eBay Average Price July | Current Price Inflation | Price Increase May to July | |

|---|---|---|---|---|---|---|

| GeForce GTX 1080 Ti | $700 | $855 | $689 | $550 | -21% | -20% |

| GeForce GTX 1080 | $600 | $606 | $526 | $395 | -34% | -25% |

| GeForce GTX 1070 Ti | $450 | $575 | $467 | $398 | -12% | -15% |

| GeForce GTX 1070 | $380 | $498 | $403 | $337 | -11% | -16% |

| GeForce GTX 1060 6GB | $250 | $366 | $327 | $273 | 9% | -17% |

| GeForce GTX 1060 3GB | $200 | $255 | $234 | $189 | -6% | -19% |

| Average | -12% | -19% |

For used AMD GPUs, I would strongly advise gamers avoid the Radeon RX 5000 series as these are pretty capable at mining relative to their gaming performance, which has kept prices inflated higher than equivalent Nvidia cards. While prices have declined here as well, a product like the RX 5700 XT is still being sold for nearly twice its $400 launch price on the used market, which makes it poor value compared to the RTX 2070 Super, a GPU that is not only faster on average, but also over $100 cheaper.

On the flip side, owners of an RX 5700 XT that have no interest in mining do have a nice upgrade path available to them, as we mentioned in last month's update. With the 5700 XT going for around $760 used, and the RX 6700 XT available for about $730 brand new on eBay, 5700 XT owners can effectively upgrade to the 6700 XT for free, gaining a decent amount of gaming performance in the process.

| MSRP | eBay Average Price May | eBay Average Price June | eBay Average Price July | Current Price Inflation | Price Increase May to July | |

|---|---|---|---|---|---|---|

| Radeon 5700 XT | $400 | $1,184 | $895 | $762 | 91% | -15% |

| Radeon 5700 | $350 | $1,035 | $806 | $719 | 105% | -11% |

| Radeon 5600 XT | $280 | $754 | $604 | $541 | 93% | -10% |

| Radeon 5500 XT 8GB | $200 | $507 | $440 | $363 | 82% | -18% |

| Average | 93% | -13% |

Older Radeon GPUs also remain quite inflated in models that have decent mining performance. Like Nvidia's Pascal family, these older products have dropped the most on average, but for gamers there is not much to see. For example, the RX 580 8GB is priced 25% higher than the GTX 1060 6GB on the used market, making it poor value. With that said, it is good to see price movement for 4GB GPUs like the RX 570 4GB, which is looking decent as a $200 stopgap option.

Takeaways

We've had largely good news to share this month, which is great for the PC hardware ecosystem. GPU prices have continued to fall month on month, at a similar rate to what we saw in June, despite a less substantial decrease in cryptocurrency prices and mining profitability. Both current generation GPUs and used older generation GPUs have seen price drops, and we're now even seeing movement in the mainstream end of the market.

This is a positive sign for gamers that have been waiting a long time to get their hands on a new GPU, but inflated pricing is far from over. It's just a step in the right direction on a path that still requires many more steps, as there is no way I would recommend people actually pay current scalper or even retail prices that remain well above their official MSRPs. Let's hope we see things continue this way, though of course there are zero guarantees.

Many are no doubt wondering when we'll see prices return to normal levels, which has been a persistent discussion for much of 2021. I don't think two months of price decreases is substantial enough to mark a future trend and make predictions just yet. We'll keep assessing the market, and hopefully we'll see more improvements. With that said, the trends we've seen this year are giving me déjà vu from when I was making updates like this during the previous crypto boom.

You can expect us to continue tracking prices, researching what is happening in the market, and we'll be back next month with another update and hopefully more good news to share.