In a nutshell: It's no secret that Nvidia saw its GPU sales fall drastically in the second quarter of the year, and the scale of the decline compared to the previous quarter was substantial. But it wasn't just Nvidia: Overall discreet desktop graphics card shipments in Q2 hit a two-year low while the CPU industry also suffered.

Jon Peddie Research's (JPR) latest report on the GPU industry is painful reading for all involved, especially Nvidia. The market has been experiencing falling demand this year following a surge in sales during the lockdowns, and the turbulent economy combined with rising inflation is making things worse.

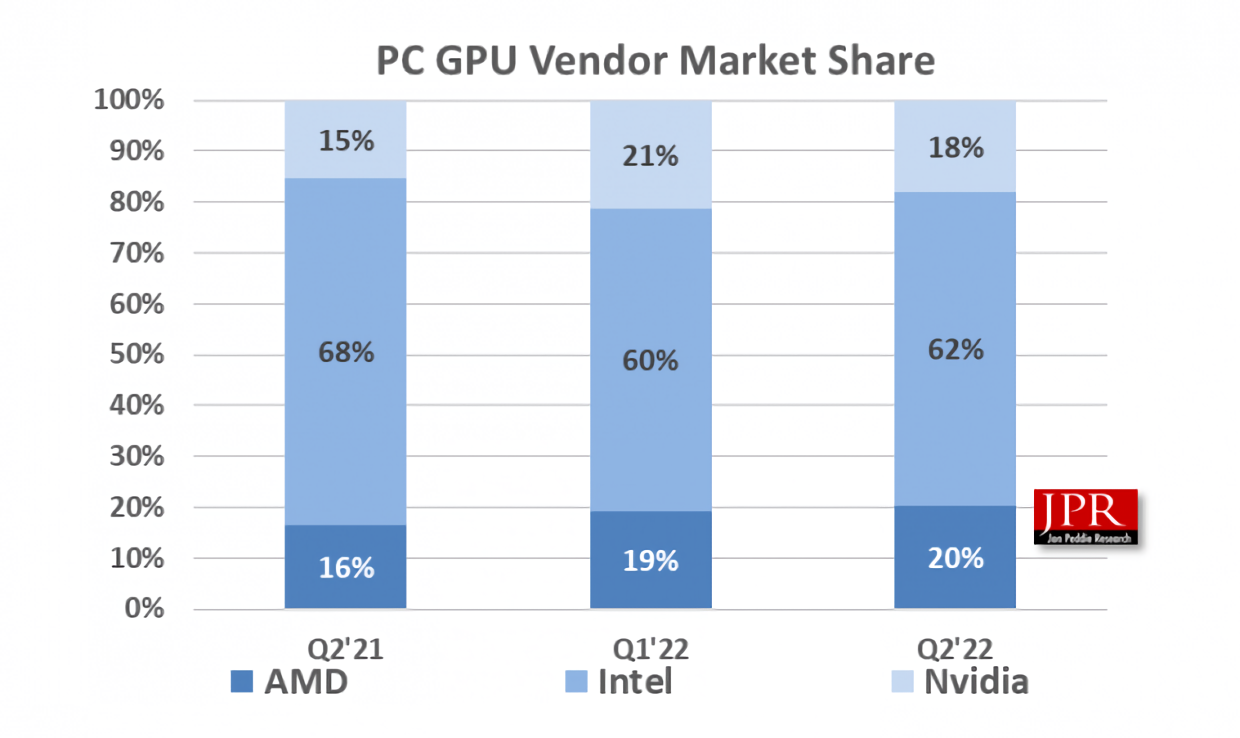

JPR found that there were 84 million GPU shipments in Q2, down 14.9% compared to Q1. Looking at the three GPU companies individually, AMD shipments were down -7.6%, Intel was down -9.8%, and Nvidia's shipments decreased by -25.7%.

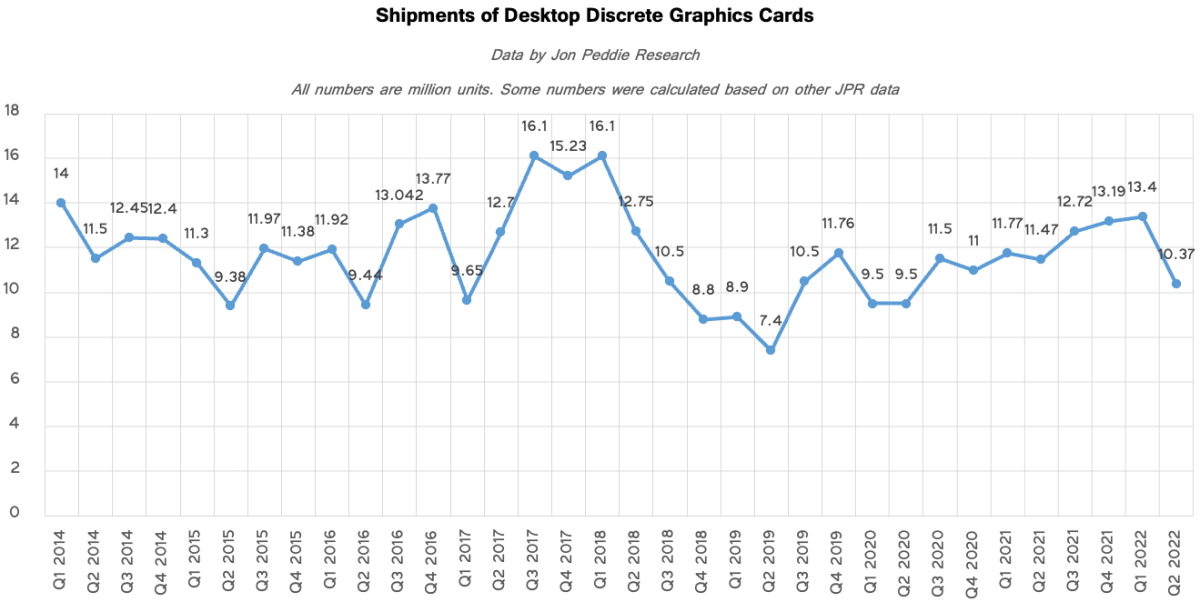

The figures were even worse for discreet desktop graphics cards. Shipments in this area were down 22.6% sequentially in the second quarter to around 10.37 million units, the lowest number seen since Q2 2020.

As for overall market shares, Intel with its integrated graphics still led the way, increasing its share by 2% to 60%. Nvidia fell -3.15% to 18%, allowing AMD to overtake it with a 1.1% rise to 20%.

The CPU market also had a bad quarter. Processor shipments were down -7% quarter-on-quarter and 37.7% year-on-year . Tablets, however, saw their shipments remain flat.

"This quarter had overall negative results for the GPU vendors, compared to the last quarter," said Jon Peddie, president of JPR. "Global events such as the continued war in Ukraine, Russia's manipulation of gas supplies to Western Europe, and the subsequent nervousness those events create have put a dampener on Europe's economy; the UK is in recession with high inflation. Forecasting has never been more challenging, and as a result, our forecast and others' will get revised frequently as new data appears."

It seems the industry isn't confident of a turnaround in the current quarter; most of the semiconductor vendors are guiding down for Q3 at an average of -2.81%.

Nvidia's latest financial results showed its gaming revenue was down by more than one billion dollars year-on-year, so the recent report's findings come as little surprise. The company has been frantically trying to clear out its excess of RTX 3000 stock before Lovelace arrives by dropping the cards' prices, but it reportedly hasn't worked as well as expected. It seems team green's solution is to reduce them even further in September. Whether that will work could depend on how much cheaper Nvidia makes its GPUs.