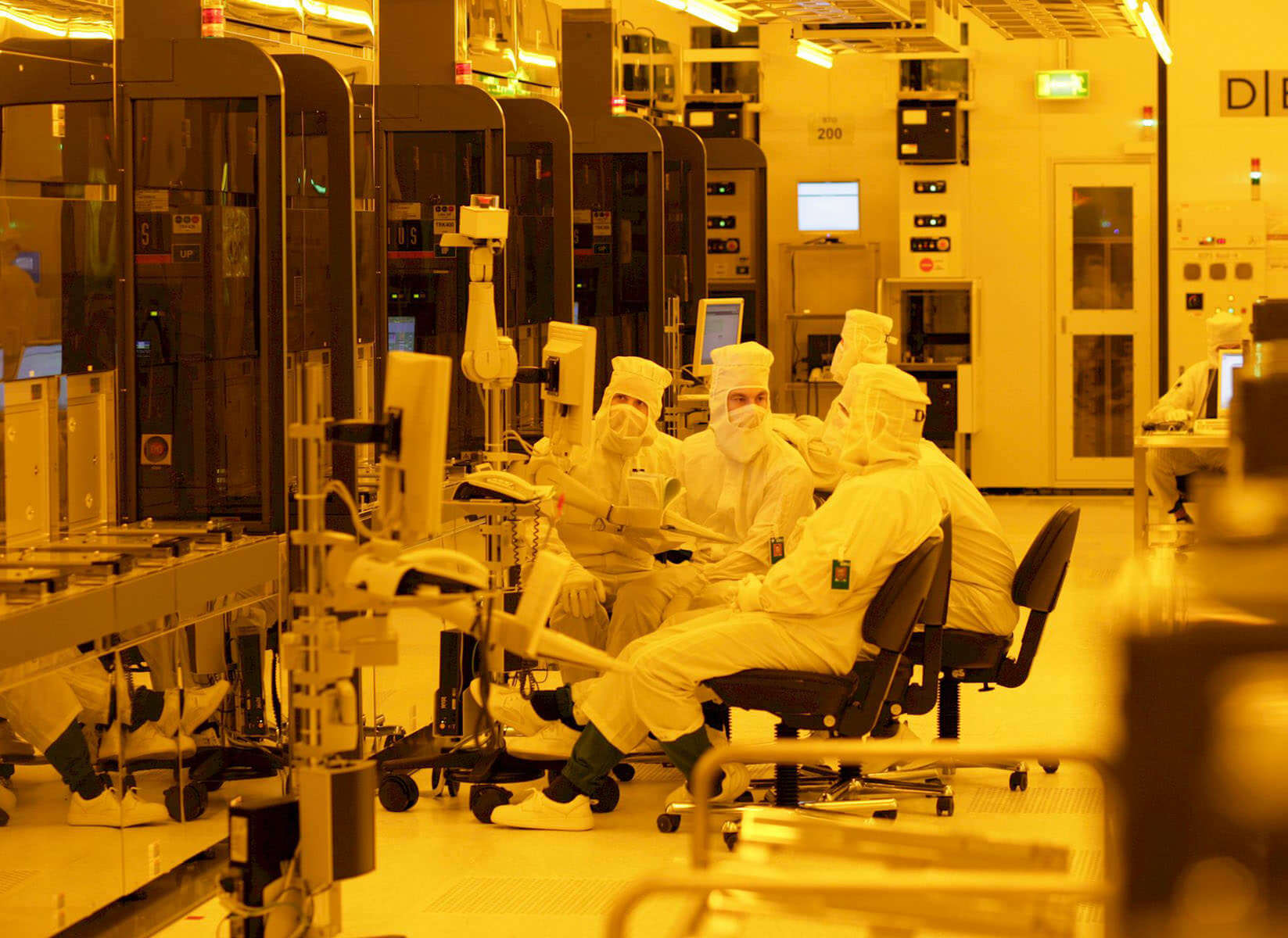

Why it matters: GlobalFoundries is withdrawing from the race to 7nm after having lost its main customer (AMD) to rival TSMC. The decision has a wide-ranging impact in company operations and will lead to additional redundancies and a reinvention of sorts for the entire company.

GlobalFoundries, the company borne of the former manufacturing arm of AMD, has announced a major restructuring of its business and a change in direction at the 7nm node.

In an announcement today, GlobalFoundries said it would double-down on its 12nm/14nm nodes (a process originally sourced from Samsung), where most of its clients sit, and will halt development of its 7nm LP process entirely. This, it says, will allow it to diversify its offer (beyond CPUs) and give other customers a chance to benefit from its mature processes with "RF, embedded memory, low power and more." This also means it will no longer be a coming 7nm partner to AMD's manufacturing needs (although it will retain current 12nm/14nm business).

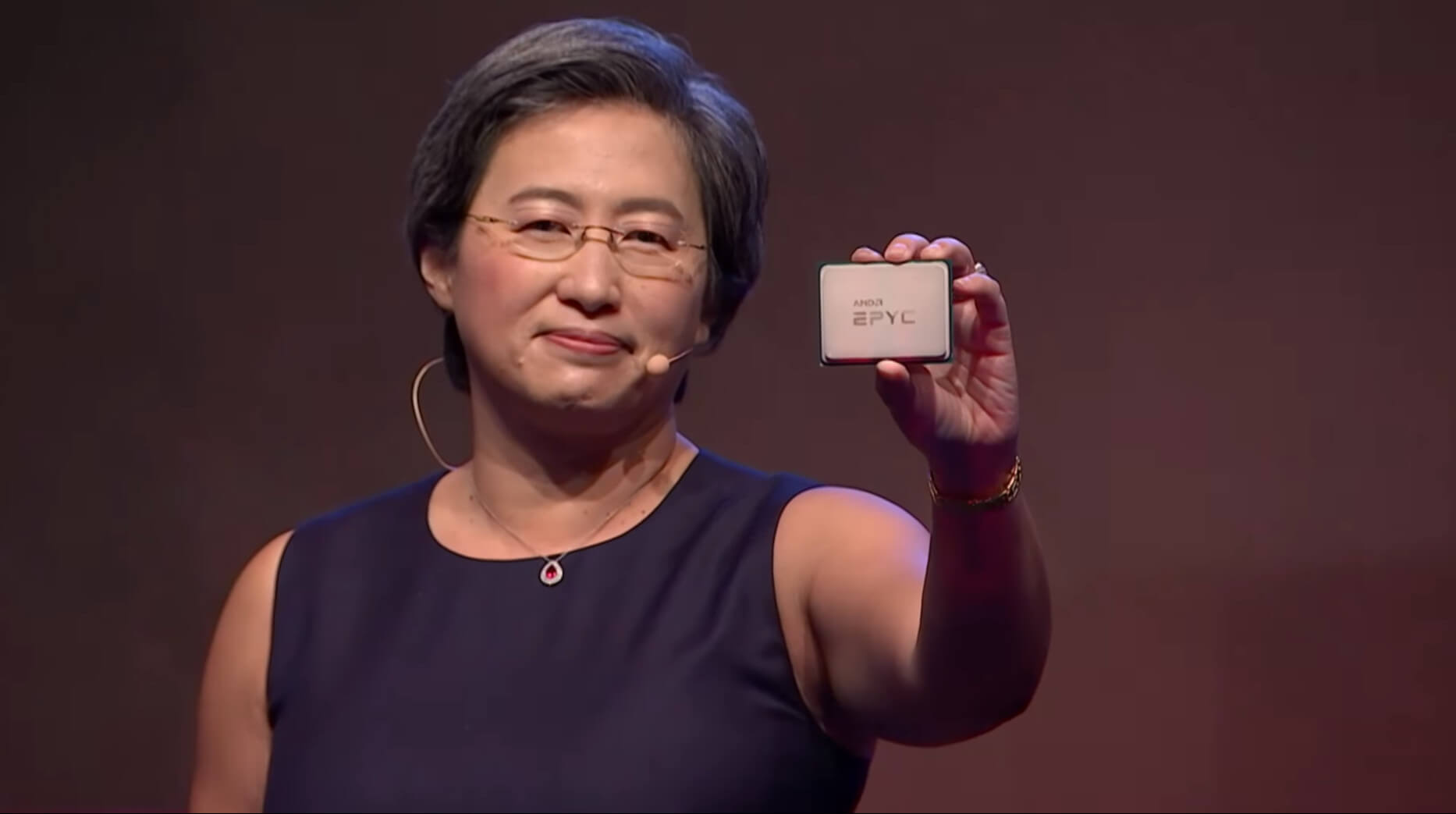

GlobalFoundries had already lost the production of AMD's EPYC "Zen 2" processors at the 7nm to TSMC, earlier this year, when it was revealed by AMD CEO, Lisa Su, at Computex 2018, back in June.

The company had been mulling over the decision in recent months, it seems. Faced with the 7nm node and the loss of its only customer to TSMC, GlobalFoundries made a hard choice of shoring up its current customers instead of moving forward without any prospective 7nm customers.

Unfortunately, there is the matter of re-allocating the surplus researchers and, despite the company already having planned a 5 percent reduction of its workforce earlier this year, GlobalFoundries will further reduce the payroll, although it is assuring a "significant number of top technologists will be redeployed on 14/12nm FinFET derivatives and other differentiated offerings."

As part of the change in direction, the company will also be spinning off its ASIC design unit into a separate, yet fully-owned, business. Apart from providing the aforementioned design services to customers, it will also "provide clients with access to alternative foundry options at 7nm and beyond, while allowing the ASIC business to engage with a broader set of clients", it said. Fewer details were given on the ASIC design unit plans. However, it seems that previous the company intends to support potential 7nm (and beyond) customers as a go-between after the design work is carried out.

The demand for wafers has sky-rocketed in recent years, but the increased buy-in cost of a new design has also substantially increased, prompting Samuel Wang, research vice president at Gartner to justify the decision, adding "while the leading edge gets most of the headlines, fewer customers can afford the transition to 7nm and finer geometries. 14nm and above technologies will continue to be the important demand driver for the foundry business for many years to come."

The 7nm node marks the parting of ways between AMD and GlobalFoundries, possibly for good.